Enzyme, formerly known as Melon, is a pioneering decentralized asset management platform that enables individuals and institutions to build, scale, and manage a wide range of investment strategies within the decentralized finance (DeFi) ecosystem.

Designed to democratize access to sophisticated financial tools, Enzyme leverages blockchain technology to offer a transparent, secure, and automated infrastructure for managing digital assets. At the heart of this ecosystem lies the MLN token, which serves as the native utility token powering the platform’s operations, governance, and incentivization mechanisms.

What is Enzyme Finance?

Enzyme is a decentralized protocol that facilitates on-chain asset management. The platform is designed to allow users—ranging from individual investors to institutional strategists to create, execute, and oversee a variety of investment strategies directly on the Ethereum blockchain.

These strategies can be discretionary, where human judgment and decision-making are applied, or automated, such as algorithmic and robo-advisory models. Enzyme also supports the creation and management of exchange-traded funds (ETFs) and market-making strategies, offering unparalleled flexibility to its user base.

A defining characteristic of Enzyme is its non-custodial nature. This means that users maintain full control and ownership of their assets at all times, with transactions and operations executed through secure, self-executing smart contracts. These smart contracts eliminate the need for traditional intermediaries such as fund managers or custodians, significantly reducing operational costs and increasing transparency.

How Does Enzyme Work?

Enzyme operates on a dual-layer architecture that separates fund creation from infrastructure-level governance and maintenance. These layers include:

Fund Layer

This layer serves as the foundation for creating and managing investment funds using smart contracts. It consists of two main components:

Hub:

- The Hub acts as the central registry and coordination unit. It provides users with the necessary tools and interfaces to create and configure funds. It tracks all the components that make up each fund, such as the manager, assets, and performance metrics.

Spokes:

- These are modular extensions that define how funds operate. Two primary functions within the Spokes layer are:

- Vaults: Secure storage for fund assets, built on Ethereum smart contracts.

- Shares: Represent ownership in a fund and facilitate investor participation and redemption.

This modular design ensures that fund managers and investors have a high degree of control and flexibility while maintaining full transparency and automation.

Infrastructure Layer

The infrastructure layer is responsible for the broader operational ecosystem. It is governed by the Enzyme Council DAO (Decentralized Autonomous Organization), which ensures decentralized oversight of critical functions, including:

- Asset Pricing: Secure and accurate price feeds to determine asset values.

- MLN-to-ETH Conversions: Facilitates liquidity for fee payments and other on-chain transactions.

- Governance Decisions: Protocol upgrades, parameter changes, and new feature approvals are handled through DAO proposals and community voting.

This bifurcation between fund creation and infrastructure management helps maintain the platform’s security, adaptability, and decentralization.

The Role and Utility of the MLN Token

The MLN token is integral to the functionality and governance of the Enzyme ecosystem. It is used to pay protocol fees, incentivize participation, and facilitate decentralized governance. By holding MLN tokens, users can participate in key governance decisions, such as proposing and voting on protocol upgrades or parameter changes.

Additionally, the MLN token serves as a fee mechanism that ensures the sustainability of the platform. Users pay MLN for accessing certain features and services, and this fee structure helps maintain economic equilibrium within the ecosystem. Through these mechanisms, the MLN token not only powers transactions but also helps shape the future direction of the protocol, reinforcing a community-driven model.

Security-Centric Architecture of Enzyme

Security is a paramount concern within the decentralized finance landscape, and Enzyme has positioned itself at the forefront of secure DeFi platforms. The protocol’s architecture is underpinned by second-generation smart contracts that are rigorously tested and audited before being deployed on the Ethereum mainnet. These audits are conducted by leading blockchain security firms, and the platform adheres to industry best practices to minimize vulnerabilities and protect user assets.

By enforcing strict security standards, Enzyme offers a robust foundation for digital asset management, ensuring the integrity and safety of user funds. However, it is important to recognize that while Enzyme facilitates seamless interactions with various DeFi protocols, it does not guarantee the security or performance of these external platforms.

Users are encouraged to conduct their own due diligence when engaging with third-party DeFi services through Enzyme.

Comprehensive On-Chain Asset Management of Enzyme Finance

Enzyme’s core proposition lies in its ability to unify multiple DeFi services and protocols within a single, user-friendly interface. This streamlined access simplifies the process of managing digital assets, allowing users to focus on strategy execution rather than technical complexities. From portfolio rebalancing to liquidity provision, Enzyme offers a comprehensive suite of tools tailored to a wide range of investment needs.

The platform’s architecture allows developers and strategists to deploy and manage investment vehicles in a trustless environment. Every transaction and operation is executed on-chain, providing full transparency and an immutable audit trail. This not only enhances trust among investors but also enables real-time tracking and reporting of fund performance.

What Are The Unique Features of Enzyme?

Enzyme stands out in the DeFi landscape due to its rich feature set, innovative design, and commitment to transparency:

Customizable Investment Vehicles

Users can build funds tailored to their unique investment goals, risk appetite, and asset preferences. These vehicles can incorporate various trading strategies, including algorithmic trading, liquidity provision, and portfolio rebalancing.

Decentralized Governance

Through the Enzyme Council DAO, control of the protocol is decentralized and placed in the hands of token holders. This ensures the platform remains adaptable and community-driven.

Seamless Integration with DeFi

Enzyme connects with prominent DeFi protocols and services. Users can manage assets on platforms like Uniswap V3, perform cross-chain operations, and access DeFi yield farming and liquidity strategies.

On-Chain Transparency

All fund activity is recorded on the Ethereum blockchain, allowing for real-time tracking of asset holdings, performance metrics, and transaction history. This level of transparency enhances trust and accountability.

Who Are The Founders of Enzyme?

Enzyme Finance was co-founded in 2016 by Mona El Isa and Rito Trinkler, both of whom bring extensive experience from traditional finance and quantitative research. Mona El Isa is a former Vice President at Goldman Sachs, where she specialized in equities and investment strategies.

Her deep understanding of financial markets has been instrumental in shaping Enzyme’s design and strategic direction. Rito Trinkler, a mathematician and technology entrepreneur, has contributed his expertise in algorithmic trading and blockchain systems to the development of the platform’s technical architecture.

Together, they envisioned a decentralized asset management system that could leverage blockchain technology to overcome the inefficiencies and barriers associated with traditional finance. Their combined vision has culminated in the creation of Enzyme—a protocol that empowers users to take control of their financial futures through decentralized, transparent, and secure infrastructure.

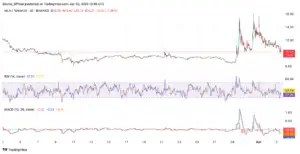

MLN Crypto Price Analysis & Technical Analysis

TradingView

$MLN is trading at $10.21, down by 1.26% at the time of writing. Currently, the token is in consolidation phase as the MACD line is at -0.23, and the signal line is at -0.21. The RSI also indicates an oversold zone. However, MLN could break out as the trading volume climbs in the next 3-5 weeks.

How to Buy/ Sell $MLN ?

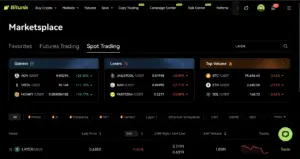

To buy $MLN, you need to create an account on Bitunix. If you are already a registered user, you can skip this step.

Next, you need to deposit USDT in your Bitunix account. Simply head to your profile and click on the wallet icon. Next, click on deposit and follow the steps to deposit crypto in your account.

To trade in MLN/USDT, navigate to the main menu and click on the Markets tab and select ‘Marketplace’.

Next, click on the search icon and look for MLN crypto.

Next, click on Trade to open the trading window for MLN/USDT.

You can choose to place a limit or a market order for buying and selling MLN tokens.

Watch our detailed tutorial on How to use Crypto Limit and Market Orders on Bitunix Futures?

How to Trade in MLN Token Futures?

To trade in MLN/USDT on Bitunix, head over to the Markets Tab and click on Marketplace from the drop down menu.

Next, click on trade to open the MLN/USDT futures pair trading panel.

Now, you can place a long or short order on MLN/USDT futures.

Wrapping Up

Enzyme represents a significant advancement in the field of decentralized finance, offering a powerful platform for on-chain asset management. Through its secure, transparent, and modular infrastructure, Enzyme enables users to build, manage, and scale a diverse range of investment strategies without relying on intermediaries.

The MLN token plays a central role in this ecosystem, powering protocol operations and facilitating decentralized governance.

With its robust security architecture, user-friendly interface, and ongoing commitment to innovation through initiatives such as the grant program, Enzyme is well-positioned to shape the future of decentralized asset management.

Whether you are a seasoned investor, a strategist, or a developer, Enzyme offers the tools and ecosystem needed to thrive in the digital financial landscape.