Solayer has positioned itself as a transformative force within the Solana ecosystem by introducing a suite of innovative features that enhance the network’s functionality. It is the first protocol on Solana that works with hardware instead of just decentralized software and cloud.

It moves some of the blockchain components into programmable chips which allows dapps to be more decentralized and scalable. With an aim to achieve higher transactions per second mark with lightning speed internet, Solayer’s use cases appear to be revolutionary.

What Is Solayer?

Solayer happens to be the first protocol on Solana that works with hardware instead of just decentralized software and cloud. It moves some of the blockchain components into programmable chips which allows dapps to be more decentralized and scalable.

With an aim to achieve higher transactions per second mark with lightning speed internet, Solayer’s use cases appear to be revolutionary.

Solayer Labs Technology: How Does Solayer Work?

Solayer’s InfiniSVM architecture can scale endlessly by utilizing SDN, RDMA, and dedicated hardware like InfiniBand technology. SDN, or Software-Defined Networking, is an approach to networking that uses software-based controllers or application programming interfaces (APIs) to direct traffic on the network and manage resources.

This allows for more efficient network management compared to traditional methods. RDMA, or Remote Direct Memory Access, is a technology that enables the direct transfer of data from the memory of one computer to another without involving the computer’s operating system. This leads to higher throughput and lower latency.

How does Solayer Crypto Power the Network?

The native token serves two purposes, security and governance. Solayer leverages a restaking protocol that enhances the network’s security and scalability. By allowing users to re-stake their Solana tokens, it strengthens the network’s economic security and execution capabilities.

It’s akin to leasing your SOL to create space for apps to operate seamlessly, while simultaneously keeping your tokens active and generating rewards.

Solayer is not a random project that generates yield out of thin air. Solayer is a liquidity protocol designed to connect Solana’s blockchain with decentralized applications (dApps) using sSOL, a yield-bearing token. At its core, Solayer’s sSOL-SOL liquidity pool boosts capital efficiency, reduces slippage, and enhances the performance of DeFi services. Here’s how Solayer operates:

Liquidity Layer with sSOL: sSOL is the cornerstone of the Solayer ecosystem, acting as a yield-bearing token representing liquidity on Solana. Users who delegate their SOL tokens to Solayer receive sSOL in return. This token can be used in liquidity pools or for supporting dApps, contributing to network security and enhancing transaction throughput (TPS) on Solana.

Delegation to dApps for Rewards: A primary utility of sSOL is its ability to be delegated to dApps. By delegating their sSOL, users help dApps scale their operations by providing the bandwidth needed for efficient performance.

In exchange, users earn rewards, such as token incentives or a share of the dApp’s generated fees. This delegation mechanism creates a win-win scenario: dApps gain vital resources to operate, while users enjoy passive income from their holdings.

Maximizing Yield Through DeFi Strategies: Solayer offers users additional opportunities to generate passive income through DeFi strategies.

By partnering with platforms like Kamino and Orca, users can deposit their sSOL into liquidity vaults or concentrated liquidity pools. These pools generate yield from trading fees and token swaps, enabling users to earn without active portfolio management.

Automated Liquidity Provision with Kamino and Orca: Solayer’s partnerships with Kamino and Orca streamline liquidity provision:

- Kamino Liquidity Vaults: Kamino automates liquidity provision on decentralized exchanges (DEXs), allowing users to earn yield without manual intervention. The platform optimizes liquidity positions to maximize returns.

- Orca Concentrated Liquidity (CLAMM): Orca utilizes a Concentrated Liquidity Automated Market Maker (CLAMM) model to improve capital efficiency. This model helps liquidity providers earn trading fees with reduced slippage, ensuring more efficient use of their deposited assets.

Oracle Price Feeds for Accurate Valuation: To maintain accurate pricing for sSOL, Solayer integrates with the Pyth oracle network. Pyth provides real-time price feeds, ensuring that the value of sSOL stays aligned with native SOL. This accurate price tracking is vital for users, liquidity providers, and DeFi platforms utilizing Solayer’s services.

Expanding sSOL Use Cases Across DeFi: sSOL’s utility extends beyond liquidity pools and staking. Users can lend sSOL as collateral on lending platforms and participate in yield farming and liquidity mining programs. These diverse use cases make sSOL a vital asset within the Solana DeFi ecosystem, enabling users to earn passive income, access liquidity, and maximize their holdings efficiently.

Solayer Airdrop Snapshot: Eligibility, Date & LAYER Price

Solayer Airdrop happened on February 11, 2025. The LAYER token was airdropped to early adopters or participating in the platform’s ecosystem, including restaking SOL tokens, delegating to Actively Validated Services (AVSs), and engaging in governance activities.

Layer token’s market cap reached $200 million hours after the airdrop event.

Solayer Crypto Price Performance and Market Analysis

Source: TradingView

- The trading price of $SOLAYER $0.637 with a market cap of $107 M. The total and max supply of $SOLAYER stands at 1 Bn. The current RSI of LAYER sits at 49 – 45 and the VWAP is below its baseline indicating that the buyers are holding out a neutral signal to the wider market.

- The price is currently 0.63835 USDT, showing a clear downtrend with successive lower highs and lower lows.

- While the RSI and VWAP shows a bearish trend, the MACD of Layer reflects a bullish crossover. Another key point to consider while strategizing Layer trade strategy is to co-incide the price of LAYER with SOL as the market has reacted to the recent events around top Solana projects accusing them of market manipulation and insider trading. SOL dropped from $190 to $168.

Who Founded Solayer ($SOLAYER)?

The minds behind Solayer are Jason Li and Rachel Chu. Jason Li, known for his expertise in blockchain technology, plays a pivotal role in the technical development of Solayer, leveraging Solana’s infrastructure.

Solayer has garnered backing from several prominent venture capital firms, including Maelstrom Fund, Finality Capital Partners, Binance Labs, Polychain Capital, and the Wormhole Cross-chain Ecosystem Fund, among others.

How to Buy/ Sell $SOLAYER ?

To buy $LAYER, you need to create an account on Bitunix. If you are already a registered user, you can skip this step.

Next, you need to deposit USDT in your Bitunix account. Simply head to your profile and click on the wallet icon. Next, click on deposit and follow the steps to deposit crypto in your account.

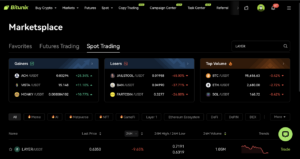

To trade in LAYER/USDT, navigate to the main menu and click on the Markets tab and select ‘Marketplace’.

Next, click on the search icon and look for LAYER.

Next, click on Trade to open the trading window for LAYER/USDT.

You can choose to place a limit or a market order for buying and selling LAYER tokens.

Watch our detailed tutorial on How to use Crypto Limit and Market Orders on Bitunix Futures?

How to Trade in LAYER Token Futures?

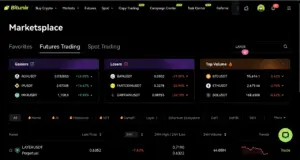

To trade in LAYER/USDT on Bitunix, head over to the Markets Tab and click on Marketplace from the drop down menu

Next, click on trade to open the LAYER/USDT futures pair trading panel.

Now, you can place a long or short order on LAYER/IUSDT futures.

How to Buy Crypto On Bitunix?

You can buy USDT through our on ramp crypto partners like Moonpay, AlchemyPay and Volet. Bitunix also offers p2p crypto trading. Following are the steps to buy USDT through a third party provider.

Navigate to Buy Crypto in the main navigation menu. Click on Buy Crypto tab and choose Third Party from the drop down menu.

Next, choose your currency, crypto and the amount you wish to spend. Now, choose your preferred payment method and click on Buy. Next, verify the payment with your bank or payment gateway (Bank or payment gateway like Apple Pay) Once done, the crypto will be reflected in your Bitunix account.

How to Buy/ Sell USDT using P2P Trading on Bitunix?

Bitunix has recently added P2P trading to make your crypto investing journey a breeze. Follow the following steps to place a P2P USDT order.

First, head over to the Buy Crypto tab in the main menu. Now, click on P2P Trading from the drop down menu.

Next, choose the amount you wish to spend and the preferred method of payment. Once done, the system matches your order requirements with the verified merchants. Now, you can choose the merchant you wish to buy your USDT from.

Next, click on Buy and make the payment. Once done, share a screenshot of the payment and click on I have Paid. Once the seller has received the amount, he/she will release the funds.

How to Deposit Crypto on Bitunix?

If you already own crypto and wish to deposit in your Bitunix account simply follow the steps below

First, navigate to the main menu and click on the wallet icon. Now, choose spot account from the drop down menu.

Next, click on Deposit from the menu to your left.

Next, choose crypto and network you wish to deposit through. This will generate your deposit address that you need to send your crypto to. Double, triple check the details before you send your crypto to the deposit address. Make sure to never manually copy the address as it might lead you to miss out any characters.

Still not sure on how to deposit crypto into your Bitunix account? Watch our detailed tutorial on How to Deposit Crypto on Bitunix?