If you’ve been around the cryptocurrency block, you’ve likely heard the term “Bitcoin halving.” It sounds like a complex financial concept, but it’s actually a fundamental part of how Bitcoin operates.

In this article, we’ll explain what Bitcoin halving is, how it works, and why it’s a big deal for investors, miners, and the general health of the overall Bitcoin ecosystem. Let’s get on with the exploration of the world of Bitcoin and explore the significance of this event.

What’s Bitcoin Halving?

First things first, let’s define what Bitcoin halving means. In the layman’s terms, a Bitcoin halving is an event where the reward for mining new blocks is halved, meaning miners receive 50% fewer Bitcoins for verifying transactions. Bitcoin halvings are scheduled to occur once every 210,000 blocks – roughly every four years – until the maximum supply of 21 million Bitcoins has been generated by the network.

Why Does Bitcoin Halve?

The halving is built into the heart of the Bitcoin protocol by Satoshi Nakamoto, Bitcoin’s mysterious creator, to ensure that Bitcoin doesn’t experience runaway inflation and to create a synthetic form of inflation that decreases over time. This process was designed to mimic the extraction of more traditional resources like gold. Just as gold becomes harder and more expensive to mine, so too does Bitcoin. Nakamoto set the cap of 21 million Bitcoins to introduce a form of ‘digital scarcity’ to the cryptocurrency, helping to ensure that it holds value over time.

Here’s a simple breakdown of why Bitcoin halving happens:

Control Inflation

Traditional currencies can lose value over time because governments can print more money whenever they decide to. Bitcoin, however, is different. There’s a fixed limit on the number of Bitcoins that can ever exist – 21 million. Halving helps control the rate at which new Bitcoins are created and released into the system, ensuring that we won’t reach the total limit too quickly. This controlled supply helps to prevent excessive inflation.

Mimic Gold Mining

The concept of halving also mirrors the process of mining gold. Over time, gold mining becomes harder and more expensive as the easier-to-reach gold is mined and new gold becomes rarer and harder to extract. Similarly, Bitcoin becomes harder to mine after each halving because the reward for mining new blocks is reduced by half, making it less profitable and more resource-intensive over time.

Create Scarcity

By setting a cap on the total number of Bitcoins that can ever exist and making them harder to mine, Nakamoto introduced a form of ‘digital scarcity’. This scarcity is crucial because it helps to maintain the value of Bitcoin over time. Much like rare diamonds or gold, the harder Bitcoin is to obtain, the more valuable it becomes.

The Mechanics of Bitcoin Halving

To understand halving, you need to know a bit about how Bitcoin mining works. Bitcoin mining involves solving complex mathematical problems that validate transactions on the Bitcoin network (a process known as proof of work). Miners who solve these problems effectively secure the network and are rewarded in Bitcoin.

When Bitcoin first launched in 2009, the reward for mining a block was 50 Bitcoins. After the first halving in 2012, it dropped to 25 Bitcoins. The second halving in 2016 saw the reward fall to 12.5 Bitcoins, and the third halving in 2020 reduced the reward to 6.25 Bitcoins. The most recent halving was held on April 20, 2024, when the reward decreased to 3.125 Bitcoins. The next Bitcoin halving event is due to happen in 2028.

How Halving Impacts Bitcoin’s Price

The effect of halving on Bitcoin’s price is of keen interest to global investors. The theory is that a reduced mining reward leads to lower availability of new Bitcoins, and if demand for Bitcoin remains strong, the price could go up. This is based on the classic economic principle of supply and demand: fewer Bitcoins being generated could mean that they become more valuable.

Historically, halving events have preceded some of the biggest runs in Bitcoin’s price history. However, it’s important to note that these price increases are not solely attributable to halving. They could be influenced by a myriad of factors, including broader economic indicators, market sentiment, and technological developments in the cryptocurrency ecosystem.

The idea behind the impact of halving on Bitcoin’s price is relatively straightforward:

Reduced Supply

After a halving, the rate at which new Bitcoins are created and enter circulation is reduced. This means fewer new Bitcoins are available for potential buyers.

Supply and Demand

The basic economic principle of supply and demand suggests that if the supply of something decreases while the demand remains the same or increases, the price should go up. So, theoretically, if fewer Bitcoins are available because of halving, and people still want to buy them, the price of Bitcoin could increase.

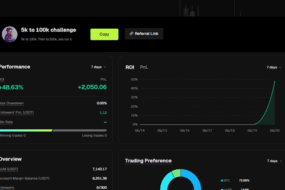

Historical Price Jumps after Bitcoin Halvings

First Bitcoin Halving (November 2012)

The reward for mining a block was reduced from 50 Bitcoins to 25 Bitcoins. Following this halving, Bitcoin’s price saw a significant increase. It rose from about $12 before the halving to nearly $1,150 a year later.

Second Bitcoin Halving (July 2016)

The reward dropped from 25 Bitcoins to 12.5 Bitcoins. Bitcoin’s price increased from about $650 at the time of the halving to approximately $2,500 in the following year and peaked near $20,000 by the end of 2017.

Third Bitcoin Halving (May 2020)

The mining reward fell from 12.5 to 6.25 Bitcoins. The price at the time of halving was around $8,600 and climbed to over $64,000 by April 2021.

Other Influencing Factors

While halving can significantly impact Bitcoin’s price, it’s important to remember that it’s not the only factor. Other elements also play a role in determining Bitcoin’s price:

Economic Indicators

General economic conditions can influence investor behavior and affect how cryptocurrencies are viewed as investment assets.

Market Sentiment

The overall feeling or attitude of investors towards Bitcoin can drive the price. Positive news can lead to price increases, while negative news can cause declines.

Technological Developments

Innovations in blockchain technology or changes in the cryptocurrency ecosystem can also affect Bitcoin’s price.

Why Halving Matters

1. Incentive for Miners

Halving is significant because it impacts the incentives for miners. As the reward decreases, the profitability of mining Bitcoins naturally becomes tighter. This can lead to a reduction in the number of miners, a more centralized mining landscape, or a push towards more efficient mining practices.

2. Market Speculation

Each halving event brings with it a flurry of speculation about potential price increases, drawing new and existing investors to the space. This can increase trading volumes and, by extension, volatility.

3. Long-term Viability

The concept of halving is crucial for the long-term viability of Bitcoin. It reassures investors and users that the coin’s design includes a method to prevent inflation, which is a key advantage Bitcoin has over traditional fiat currencies.

Key Takeaways

Bitcoin halving is an important event that helps control the circulation of new Bitcoins and can have significant implications for the crypto market. Understanding these dynamics is crucial for anyone involved in the space, whether you’re trading day-to-day or investing long-term.

As we continue to watch the fascinating development of Bitcoin and its impact on the financial world, it’s clear that halving is much more than just a technical procedure within the blockchain. It’s a testament to the unique economic model that Bitcoin has introduced, one that continues to attract, challenge, and fascinate users around the globe.

As we look to the future, one thing is certain: the world of cryptocurrency will keep us on our toes, and Bitcoin halving will play a crucial role in shaping this dynamic field.

FAQs

What is Bitcoin halving?

Bitcoin halving is an event where the reward for mining new Bitcoin blocks is cut in half, meaning miners receive 50% fewer Bitcoins for verifying transactions. This event occurs roughly every four years or after every 210,000 blocks mined until the total supply of 21 million Bitcoins has been reached.

Why does Bitcoin halve?

Bitcoin halving is designed to prevent inflation and ensure the cryptocurrency remains valuable over time. It was implemented to mimic the decreasing supply of resources like gold, creating a form of ‘digital scarcity.’ Halving slows the rate at which new Bitcoins are created, thus preserving the currency’s value.

How does Bitcoin halving impact miners?

Halving reduces the Bitcoin reward for miners, which can decrease their profit margins. This might lead some miners to cease operations if it becomes unprofitable, potentially leading to a more centralized mining landscape or pushing miners towards more efficient mining practices.

What effect does halving have on Bitcoin’s price?

Theoretically, halvings reduce the supply of new Bitcoins entering the market, which can lead to an increase in Bitcoin’s price if demand remains strong. Historically, halving events have often been followed by price increases, though these are influenced by various factors like market sentiment and broader economic conditions.

Can you give examples of how Bitcoin’s price changed after past halvings?

After the first halving in 2012, Bitcoin’s price increased from about $12 to nearly $1,150 within a year. The second halving in 2016 saw the price rise from around $650 to about $2,500 in the following year, eventually reaching nearly $20,000. Following the third halving in 2020, the price moved from around $8,600 to over $64,000 by April 2021.

What are some factors that could affect Bitcoin’s price besides halving?

Aside from halving, Bitcoin’s price can be influenced by economic indicators, market sentiment, and technological developments within the cryptocurrency ecosystem. Factors such as global economic conditions, investor attitudes, and innovations in blockchain technology can significantly impact the price.

Why is Bitcoin halving important for the long-term viability of Bitcoin?

Halving is crucial for maintaining Bitcoin’s long-term viability by ensuring that inflation is controlled and that the cryptocurrency remains a deflationary asset. This process reassures investors and users of Bitcoin’s stability and sustainability, providing a check against the inflationary tendencies seen in traditional fiat currencies.